Online and Mobile Banking

Contactless Payments

Use your debit card on your smartphone or smartwatch without physically having to swipe it. While your physical card will still work as a backup option, contactless payments minimize the need to touch terminals, provide a faster checkout experience and keep a history of transactions and locations for easy reference.

Support Information

If you need further help, call the number below and ask for our digital banking department:

(580) 223-1111

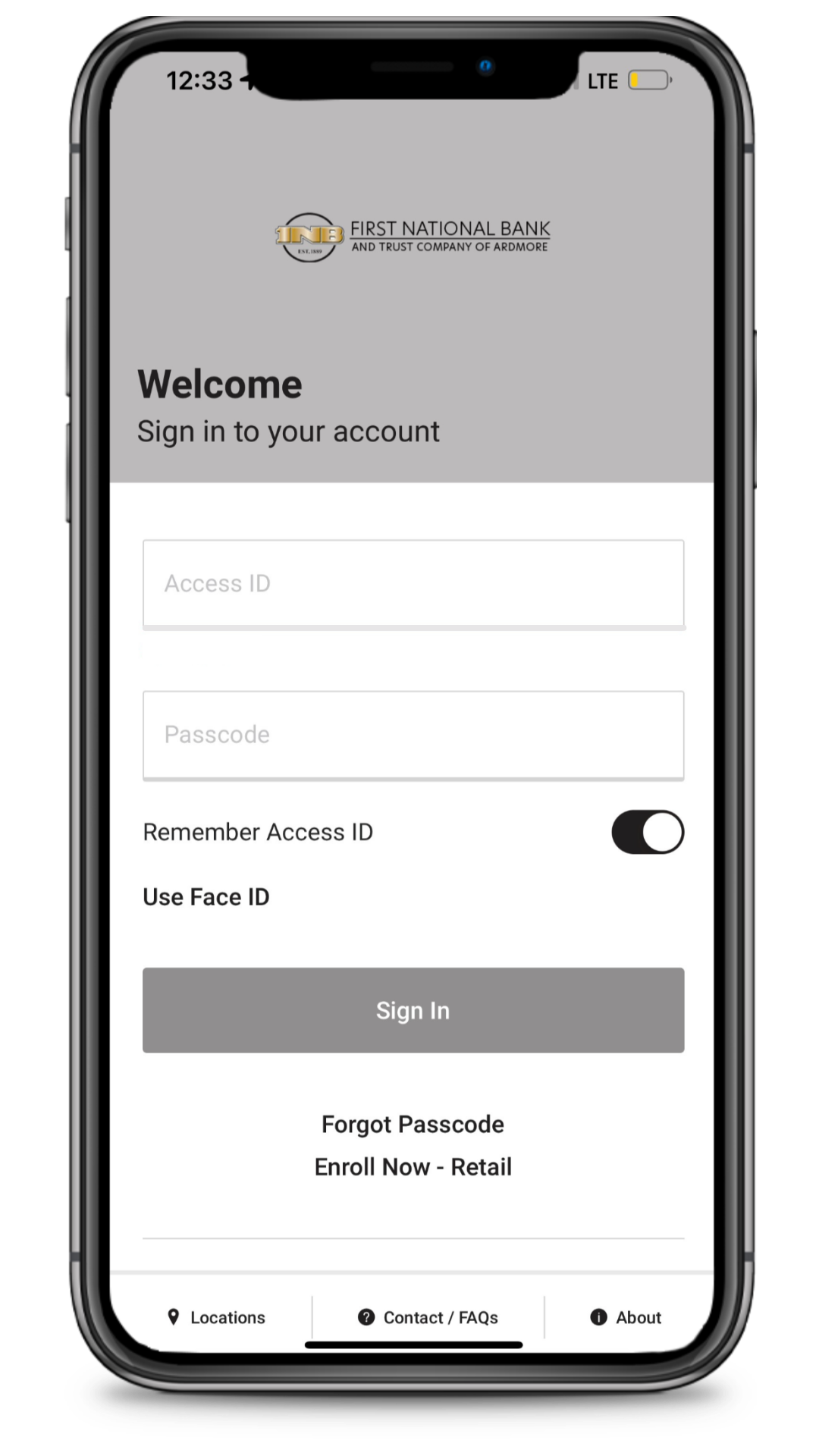

Secure Online Banking Login

Online banking with 1NB gives you fast, simple and convenient control over your money. Access your account with ease and enroll for online banking today.

Online and Mobile Banking Resources

24/7 Support

Contact 1NB or our customer support center for help. Not sure which option to choose? Check our “Who Should I Call for Support?” information.

Who Should I Call for Support?

When to Call (855) 532-4888 for 24/7 Support

1. Password or User ID not working (must have logged into the system successfully at least once in the past)

2. Nothing displays when logged in

3. You forgot your security questions

4. Functionality on the online banking site not working correctly (i.e. Transfers, Bill Payment, etc.)

When to Call 1NB

1. TELEBANK not working correctly for you

2. You see a transaction that’s not correct

3. An account is not listed you think should be

4. Any other detail of your account that is not online banking related but will require a 1NB employee to research

E-Statements

An e-statement is the same thing as a paper statement except it is available online. When the statement is ready, an email is sent notifying you that your e-statement is available.

E-statement delivery allows you to receive your account information quickly and securely. Your statements are available online for 18 months. However, you can save your statements on your computer for long-time access. This convenient delivery method expedites statement delivery, eliminates the hassle of storing any paper statements, and provides you with a convenient, secure storage system. It also helps the environment by reducing paper usage. (Go green!) No additional fees apply.

To enroll in e-statements follow these simple steps:

- Log in to your online banking account.

- Click on the “Statements” tab to see your e-statements. (If you do not see all of your accounts, go back to online banking and verify any accounts that are not listed. If all your accounts are not listed, click the “Users Services” tab and click the link “Add New online Account”. The bank will receive your request, verify the information is correct, and activate the account for online access which allows you to view the e-statement. This usually takes no more than 24 hours for the bank to process.)

- Read and accept any disclosures where prompted, especially if this is the first time you have clicked the “Statements” tab.

- Click and verify that each account opens a PDF e-statement for the account. If you do not see an account listed for e-delivery in the “Statements” tab, go back and complete step #2, or feel free to call us.

E-statement Only (CPA, Bookkeepers, etc.)

Click here for E-statement access only for accountants, bookkeepers, etc. This link and login does not have access to online banking features.

Bill Payment

After enrolling in online banking, you will have the option to add the bill pay feature which allows you to pay recurring, occasional, and one-time bills from your computer 24 hours a day.

- Faster Payment – some payees will receive payment days earlier.

- Easy Navigation – your information is organized.

- Convenient Payment History – view your pending transactions or payment history with just the click of a button.

Mobile Check Deposit

Default daily limit of $2,000 deposit, 30-day limit of $4,000 and limited to 10 deposits in 30-day period. Other options may be available by calling 1NB directly; ask for the Digital Banking Department.

Deposits Submitted after 4:00 PM will post the next business day.

ITEMS NOT ELIGIBLE FOR MOBILE DEPOSIT

* A third-party check.

* An item drawn on your personal account at 1NB.

* An altered item.

* A “substitute check,” as defined in Regulation CC.

* An item drawn on a financial institution in a foreign country.

* A “remotely created check.”

* A “stale dated,” “expired”, or “postdated” item.

* A “non-negotiable” item.

* An item that has previously returned for any reason.

* An item that is incomplete.

* Tax Refund Checks.

* Checks Payable to Cash.

* Lottery or Sweepstakes Checks

*You will be charged internet access rates depending on your carrier. Web access is needed to use mobile banking. Check with your service provider for details on specific fees and charges.

First National Bank and Trust Company of Ardmore Inc

Main Branch

405 West Main Street

Ardmore, OK 73401

Helpful Support Numbers

Lost/Stolen Debit Card: 1-800-523-4175

Debit/ATM Card Activation: 1-866-985-2273

PIN Change: 1-866-985-2273