Personal Banking Services Tailored to You

1NB is committed to providing our fellow Oklahomans with accessible personal banking features to handle your everyday financial needs from your checking and savings accounts to loans, mortgages and more.

Secure Checking Account

Our Secure Checking account provides the basic essentials you need to start banking with affordable fees and minimums plus powerful security features. Access Secure Checking benefits here (must have current active open account)

Features

- Overdraft protection available (must qualify)

- $50 minimum to open

- $6 maintenance fee per statement cycle

- $2 paper statement fee

- ID protection and credit monitoring

- FREE ATM/Debit card, Online Banking and Bill Pay

Choice Checking Account

Features

- Overdraft protection privilege (must qualify)

- $50 minimum to open

- $2 paper statement fee

- FREE ATM/Debit card, Online Banking and Bill Pay

- FREE e-statement

First Class Now Checking Account

Features

- Overdraft protection available (must qualify)

- FREE Checks (wallet only, one box per year, 1/2 price on second order)

- FREE money orders/cashier checks

- $1,500 minimum to open

- $7 monthly maintenance fee

- $2 paper statement fee

- FREE ATM/Debit card, Online Banking and Bill Pay

- FREE e-statement

- $15 safe deposit box discount for first year

Classic 55 Checking Account

Features

- FREE paper and e-statements

- FREE Checks – Wallet Only One box per year 1/2 price on second order

- Overdraft protection available (must qualify)

- $50 minimum to open account

- FREE ATM/Debit card, Online Banking and Bill Pay

Savings Account

Features

- Interest compounded daily and credited monthly

- FREE e-statements

- $50 minimum to open account

- $2 paper statement fee

- Minimum balance of $50 required to avoid monthly maintenance fees

Money Market Account

Features

- Interest-bearing tiered-rate account

- $2,500 minimum to open

- $2 paper statement fee

- FREE e-statements

- $11 monthly maintenance fee; waived if minimum balance of $5,000 or an average daily balance of $10,000

Certificates of Deposit (CDs)

Features

- 7–89 Day CD

- 3 Month (90–179 Day)

- 6 Month (180–364 Day)

- 1 Year (12–17 months)

- 18–23 Month

- 2 Year (24–47 months)

- 2 1/2 Year “First Choice”

- 4 Year

1NB Fee Schedule

If you have any questions, please call 580-223-1111 or email custservice@1nb.com

1NB in Your Wallet

Personal Loans

Contact your local 1NB for details.

Auto Loans

Unsecured Loans

Recreational Vehicle Loans

CD and Savings Loans

Apply for Your Personal Loan Today

Mortgage and Home Equity Loans

Whether you’re looking to buy a new home or refinance your property, 1NB offers a range of lending options to help you get where you want to be.

Bounce Relief

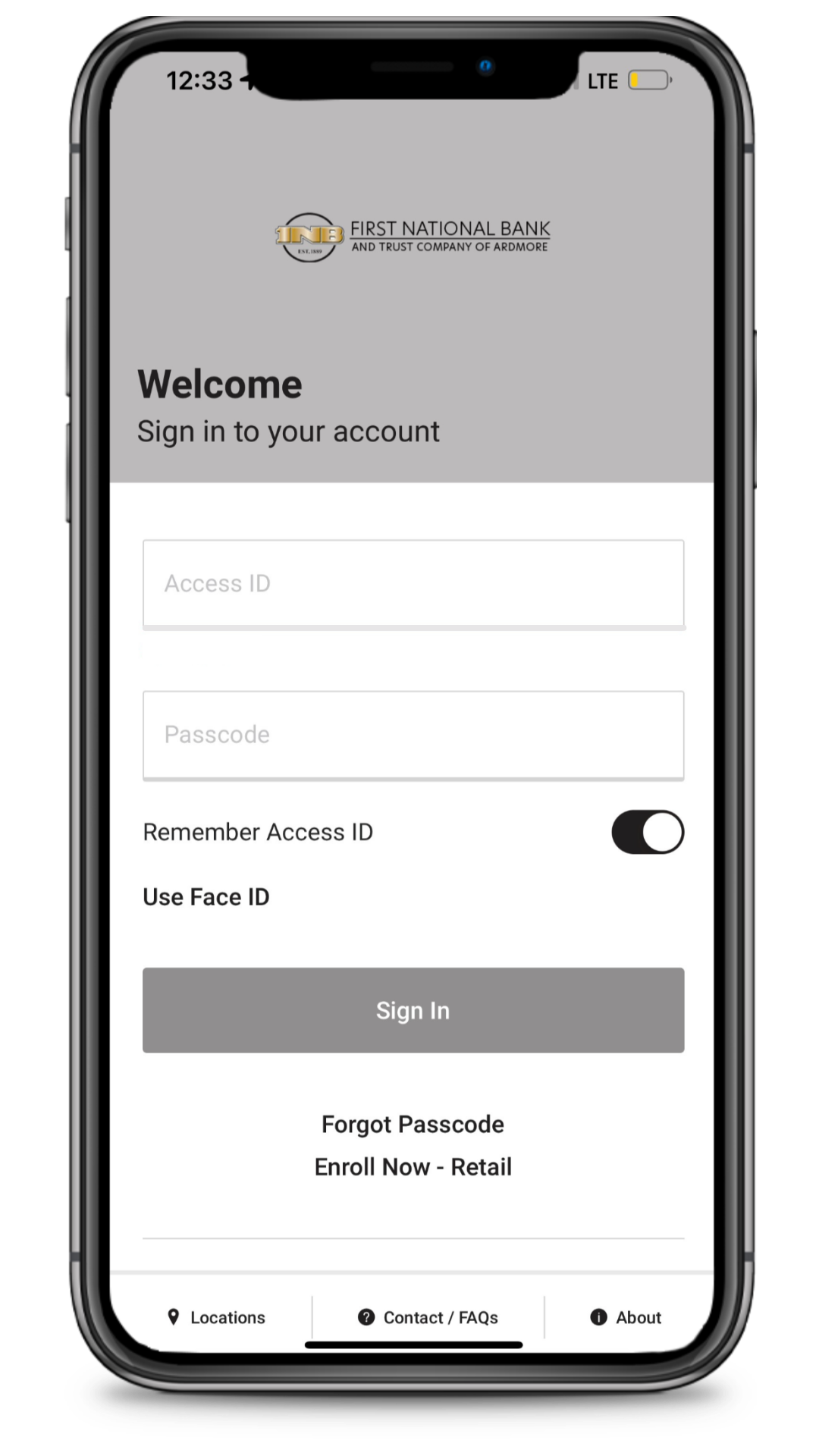

Online and Mobile Banking

Bank With 1NB

Call for Support

Resources

First National Bank and Trust Company of Ardmore Inc

Main Branch

405 West Main Street

Ardmore, OK 73401

Helpful Support Numbers

Lost/Stolen Debit Card: 1-800-523-4175

Debit/ATM Card Activation: 1-866-985-2273

PIN Change: 1-866-985-2273